What is personal cyber liability insurance?

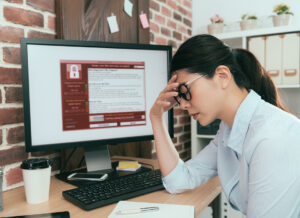

Homeowners insurance protects your home and belongings from damage or loss due to perils like fire, theft, and weather. But what about your digital life? That’s where personal cyber insurance comes in. This type of insurance helps to protect you from the financial damages that can result from a cyberattack, such as identity theft, ransomware, and credit card fraud.

In most cases, personal cyber insurance will cover the costs of restoring your data and repairing any damage to your computer or other devices. It can also provide you with financial assistance if you need to hire a professional to help you recover from a cyberattack. So, if you want to be protected against the growing threat of cybercrime, be sure to ask your homeowner’s insurance agent about personal cyber insurance.

Just about anyone who uses the internet could benefit from a personal cyber liability insurance policy.

[/nectar_highlighted_text][divider line_type=”No Line”]

Who needs it?

Just about anyone who uses the internet could benefit from a personal cyber liability insurance policy. That’s because cybercrime is becoming more and more common, and it can happen to anyone. A personal cyber liability insurance policy can help to cover the costs of cybercrime, including damages, theft, and identity theft. So if you’re looking for peace of mind, a personal cyber liability insurance policy is a good idea.

Just about anyone who uses the internet could benefit from a personal cyber liability insurance policy. That’s because cybercrime is becoming more and more common, and it can happen to anyone. A personal cyber liability insurance policy can help to cover the costs of cybercrime, including damages, theft, and identity theft. So if you’re looking for peace of mind, a personal cyber liability insurance policy is a good idea.How much does it cost?

So, do you really need personal cyber liability insurance? The answer is probably yes, especially if you don’t want to risk being on the hook for hundreds (or even thousands) of dollars in damages if your identity is stolen. How much does this coverage cost? That depends on a few factors, but it’s usually not too expensive—especially when compared to the potential costs of not having protection. Protect yourself against the cost of identity theft by getting personal cyber liability insurance today.